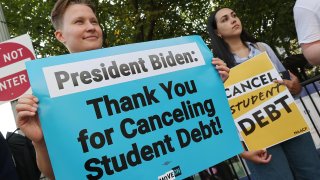

Any day now, federal student loan borrowers throughout the U.S. could see their balances reduced by up to $20,000 thanks to President Biden's student debt forgiveness plan. The administration is waiting on a green light from a federal judge to actually start reducing balances, but still says applicants can expect good news in the coming weeks.

While recipients won't see that aid in the form of a check, any remaining balances will be re-amortized, meaning monthly payments will be recalculated to reflect the new balance. For borrowers, that means monthly payments could drop by up to $300 per month.

That extra cash will be a much needed lifeline to cover other bills or necessary expenses for many. But some borrowers plan to spend the money more freely.

In fact, 73% of anticipated recipients say they expect to spend their debt forgiveness on non-essential items, including travel, dining out and new tech, according to a recent survey from Intelligent.com.

That discretionary spending won't come guilt-free though. The same percentage of recipients — 73% — say using debt forgiveness funds on non-essentials isn't the right thing to do.

Both your personal spending habits and how you view the morality of debt are nobody's business but your own. But if you're waiting to see your student loan balance shrink, it's a good idea to check in on your financial goals and desires before your budget changes so you can get the most out of any extra money.

Of course, not everybody starts looking up flights the minute they get a little unexpected cash or their monthly expenses drop significantly. The sames goes for many of those waiting for debt forgiveness.

Money Report

Around 37% of respondents said they are very likely to spend the extra money on housing costs or groceries, which is not surprising given the way prices for both items have gone up this year.

It's not free money, but debt forgiveness can still help you build wealth

Recipients shouldn't look at debt forgiveness as a cash windfall, but rather as an investment in their future, says Jason Blumstein, a chartered financial analyst (CFA) who offers behavioral coaching.

"If you look at it as a 'windfall' and spend it on non-essentials, you're not getting ahead," Blumstein tells CNBC Make It. "If you look at it as paying my future self instead of the student loan debt, you can start to build wealth for yourself."

Aside from covering immediate needs, it's important to maintain a balance between non-essential spending and working toward long-term financial goals, Blumstein says.

"If we are only living for the short-term, or using all of the debt forgiveness on 'fun' non-essential spending, our long-term selves should eventually be harmed," says Blumstein.

However, "if we only use the debt forgiveness for our long-term goals, our short-term selves might feel burdened or stressed by not having any 'fun' non-essentials — which might then lead someone to give up on their long-term goals."

For some borrowers with high balances, the change in monthly payments might not even be noticeable. But every little bit helps. As interest returns, it's smart to keep track of your spending and stay on top of your minimum payments.

Want to earn more and work less? Register for the free CNBC Make It: Your Money virtual event on Dec. 13 at 12 p.m. ET to learn from money masters like Kevin O'Leary how you can increase your earning power.

Check out:

Borrowers react to student loan forgiveness: 'A huge weight has been lifted off of my shoulders'

Student debt experts say $10,000 isn't enough specifically for Black borrowers—here's why