Everything You Need to Know About the Second Round of Coronavirus Stimulus Checks

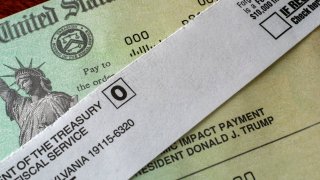

Congress is set to pass a nearly $1 trillion coronavirus relief bill that includes another round of stimulus payments for many taxpayers.

The slimmed-down checks are worth $600 for individuals earning up to $75,000 and couples earning $150,000, half the value of the first round of checks issued under the Coronavirus Aid, Relief and Economic Stability, or CARES, Act. Taxpayers will also receive an additional $600 for each child under age 17.

Don't miss: The best 0% APR credit cards with no interest for up to 20 months

Many Americans and economists have said that a one-time $600 payment is not enough to make up for months of missed rent and other bills. The federal relief package also includes enhanced unemployment benefits and funding for increased food aid and emergency rental assistance.

Here's what we know about the second round of economic impact payments:

How much are the checks worth?

The checks are worth $600 for individuals whose gross adjusted income was under $75,000 in 2019 and couples who earned under $150,000 — the same income requirements as the first round of checks. The amount of the check then decreases by $5 for every $100 of income above those thresholds, phasing out completely at $87,000 for individuals and $174,000 for couples.

Money Report

Dependents under age 17 are also eligible for $600 checks, and there's no cap on the number a household can receive. So if a single person earned $50,000 in 2019 and has four children under 17, the individual will be eligible for a $3,000 payment.

Who is eligible to receive a payment?

You need a Social Security number to qualify for a relief check. As noted above, individuals earning up to $75,000, and couples earning up to $150,000 will receive the full amount. After that, the checks will phase out as detailed above. Income is based on 2019 tax returns.

Once again, adult dependents do not qualify for a check. However, this time, eligible members of mixed-status families — in which some members have Social Security numbers and some do not — will be eligible for checks, says Kathleen Romig, senior policy analyst at the Center on Budget and Policy Priorities.

Under the CARES Act, households that had a single member without a Social Security number disqualified the entire household from receiving a payment. Crucially, citizen family members will also be able to receive the first check retroactively if they meet the other eligibility requirements.

Will gig workers get a stimulus check?

Yes, as long as you meet all of the other eligibility requirements.

Are the checks taxed?

The checks are not taxable.

When will the checks be sent out?

Treasury Secretary Steve Mnuchin told CNBC on Monday that checks could start being sent as soon as next week.

But arrival timelines will vary for different taxpayers. The IRS started sending out the first round of payments about two weeks after the CARES Act was enacted in the spring. However, it took months for some people to receive their checks as the IRS worked out kinks and collected taxpayer information. Some people still have not received the first payment.

This time around, the IRS already has most taxpayers' information and the infrastructure to send out the payments, so turnaround might be quicker for many people.

How will the checks be sent?

The checks will be sent via direct deposit if you've already provided the IRS with your bank account information. If you received the first check directly into your account, then you're all set.

If the IRS doesn't have your direct deposit info, you will likely get a check in the mail, or a pre-paid debit card like the last round of payments.

What if I still haven't received the first payment?

The deadline for the first checks has passed, however if you are eligible and still haven't been paid — or you believe the amount you did receive is incorrect — you can claim a "recovery rebate credit" when you file your 2020 taxes next year. There is more information about this on the IRS site.

Check out: Americans call slimmed down $600 stimulus checks a 'disgrace' but better than nothing

Don't miss: The best 0% APR credit cards so you can finance your debt or new purchases interest-free