- Skyrocketing auto insurance costs helped contribute to inflation accelerating at a faster-than-expected pace in March.

- On a monthly basis, car insurance prices as part of the consumer price index rose by an unadjusted 2.7%, while the year-over-year increased by 22.2%, according to data released Wednesday.

- The rise in insurance costs is in addition to historically high prices for new and used vehicles since the coronavirus pandemic, as well as rising costs to repair vehicles.

DETROIT – Skyrocketing auto insurance costs helped contribute to inflation accelerating at a faster-than-expected pace in March and are adding to the ever more expensive costs for U.S. vehicle owners.

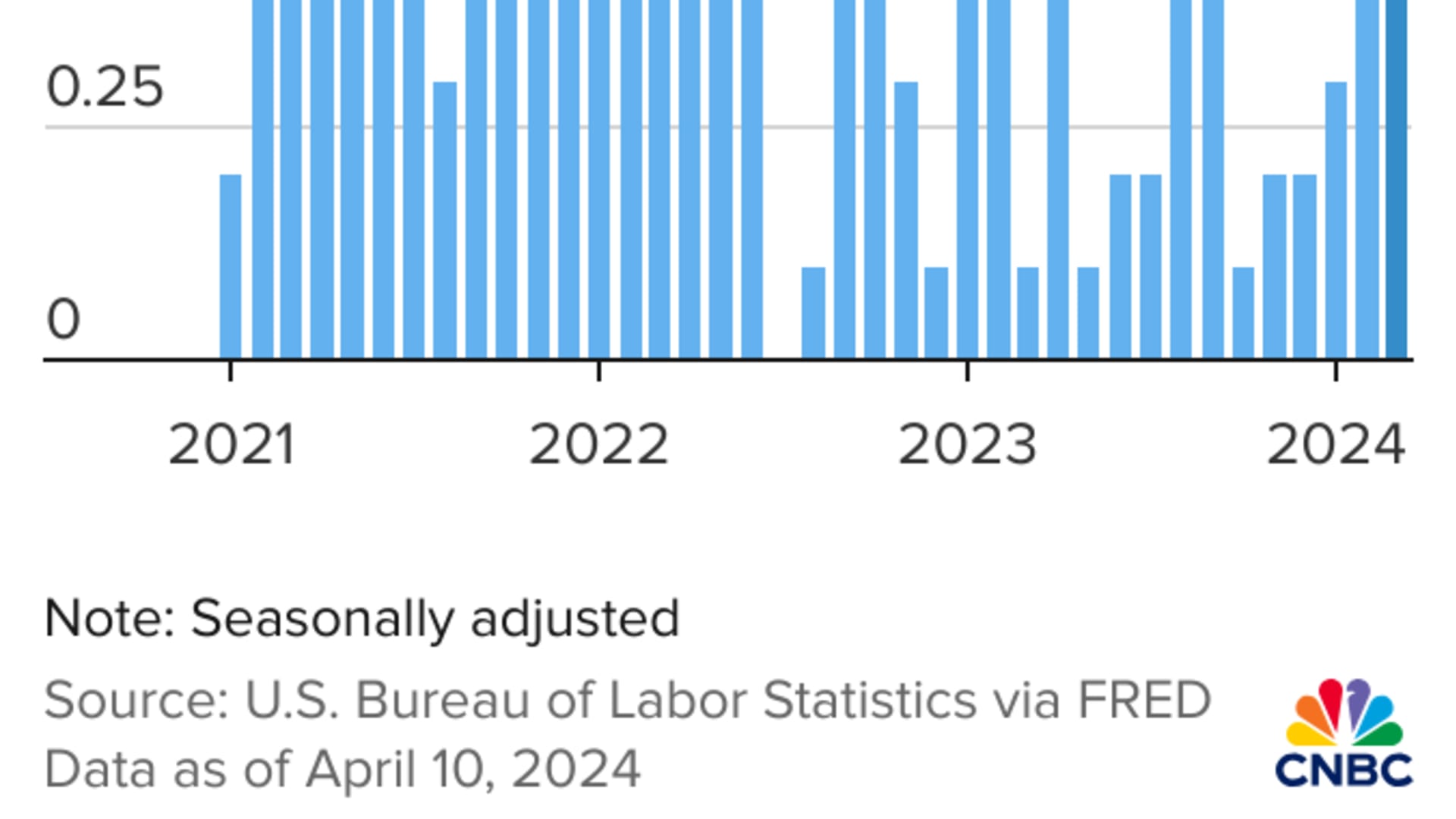

On a monthly basis, car insurance prices as part of the consumer price index rose by an unadjusted 2.7%, while the year-over-year increased by 22.2%, according to data released Wednesday. The index is a key inflation gauge and a broad measure of the cost of goods and services across the economy.

Auto insurance costs have been on the rise for some time, growing every month as part of the index since December 2021. Since then, costs have increased by 45.8%, according to U.S. Bureau of Labor Statistics. However, auto insurance remains a small portion of the CPI, with a 2.85% weighting.

The uptick comes on top of historically high prices for new and used vehicles since the coronavirus pandemic. It's also become increasingly more expensive to repair vehicles due to supply chain shortages, mechanic wage increases and additional technologies in vehicles such as microprocessors, cameras and other sensors — all of which contribute to higher vehicle and insurance costs.

"There's not a single factor, but I think the biggest factor is a combination of new cars and more expensive, so if you total your car the replacement cost is really high and a fender bender is very expensive right now," said Sean Tucker, senior editor at vehicle valuation and automotive research company Kelley Blue Book. "The technology in the cars, it's a very specific problem."

Money Report

Instead of having to replace a plastic or steel bumper on many vehicles, a simple fender bender can now damage cameras, proximity sensors and varying other technologies used for newer safety features and tools such as cruise control, parking and emergency braking.

"Premiums have been on the rise because the cost of what goes into auto insurance has been rising," David Sampson, CEO and president of the American Property Casualty Insurance Association, told CNBC. "There's a long lag time between when the trends emerge and companies see these loss trends existing. It then takes time for them to build that into their rate application filings."

Earlier this year, Sampson himself had slight damage to a bumper on a 2024 pickup truck on his property that he says was quoted to cost him $1,800 to repair or replace.

"All of the technology that we've come to rely on makes makes the replacement or repair of these vehicles really, really, costly," said Sampson, whose organization is the primary national trade association for home, auto and business insurers.

The insurance cost increases on inflation come more than two years after the Biden administration largely blamed used car prices for pushing inflation higher in January 2022.

Mitchell, an automotive software provider specializing in collision repair and auto insurance sectors, said repair costs were increasing at an annual rate of about 3.5% to 5% prior to the coronavirus pandemic. As of 2022, the increases have been at 10% or above, with the average repairable estimate for a vehicle at $4,721 in 2023.

Consumers and companies alike aren't happy with the increases. J.D. Power in June reported auto insurers lost an average of 12 cents on every dollar of premium they collected in 2022 — the worst performance in more than 20 years — leading them to raise rates at the expense of customer satisfaction.

"What I always remind folks is that insurance is based on actuarial science, so it's not a case of insurers just deciding that they want to increase premiums," Sampson said. "The filings have to be based on actuarial loss trends in their rate applications in each state."

The cost of vehicle insurance — which is mandatory in almost every state — varies by provider, driver, coverage and location. Nearly all states have minimum requirements for liability coverage, but there are a number of other coverages that may or may not be required in a specific state, according to insurance provider Progressive.

The list of optional and mandatory coverage areas can be quite long and expensive for drivers, which has led many insurance companies to offer usage-based insurance, or UBI, programs that base the cost of a policy on a driver's behaviors using telematics data.

Customers who are new to an insurer have a UBI participation rate of 26%, according to the J.D. Power's U.S. Auto Insurance Study from June.

The study, in its 24th year, found UBI usage more than doubled from 2016 to 2023, with 17% of auto insurance customers participating in such programs. Price satisfaction among customers participating in these programs is 59 points higher on average than among non-participants, according to J.D. Power.

Usage in such programs is only expected to increase as costs rise and insurers offer discounts or special prices for safer drivers, according to insurance companies.

Based on J.D. Power's survey, UBI programs from Geico, Progressive, State Farm and Liberty Mutual were ranked above average by customers. USAA, which services all branches of the military and their families, ranked the highest.

J.D. Power's study also found the cost increases have led to a more than 20-year low in customer satisfaction with auto insurance companies.

"Overall customer satisfaction with auto insurers has plummeted this year, as insurers and drivers come face to face with the realities of the economy," Mark Garrett, director of insurance intelligence at J.D. Power, said in a June release.

— CNBC's Robert Ferris and Jeff Cox contributed to this article.