- The onset of the Covid-19 pandemic prompted a financial emergency for many Americans living paycheck to paycheck.

- Two years later, a similar event would still wreck budgets, a poll finds.

- Programs to let workers save through employer-provided emergency savings accounts could encourage workers to set aside more cash for unforeseen events.

When the Covid-19 pandemic hit, many Americans felt the financial shock of a sudden drop in income.

If the same kind of event were to happen today, many people would still struggle financially, according to a poll conducted by the Bipartisan Policy Center, Funding Our Future coalition and Morning Consult.

What's more, the stopgaps provided by the government — namely stimulus checks and monthly child tax credit payments — are no longer available to help curb financial distress.

But one solution — emergency savings plans provided through employers — could help, according to the report.

How Americans are struggling

The survey found 42% of employed Americans feel very or somewhat financially insecure. Moreover, 24% have zero savings set aside for an emergency expense.

Money Report

Notably, the poll does not factor in the 40% of adults who are not employed. If it did, the emergency savings shortfall would likely be even more pronounced.

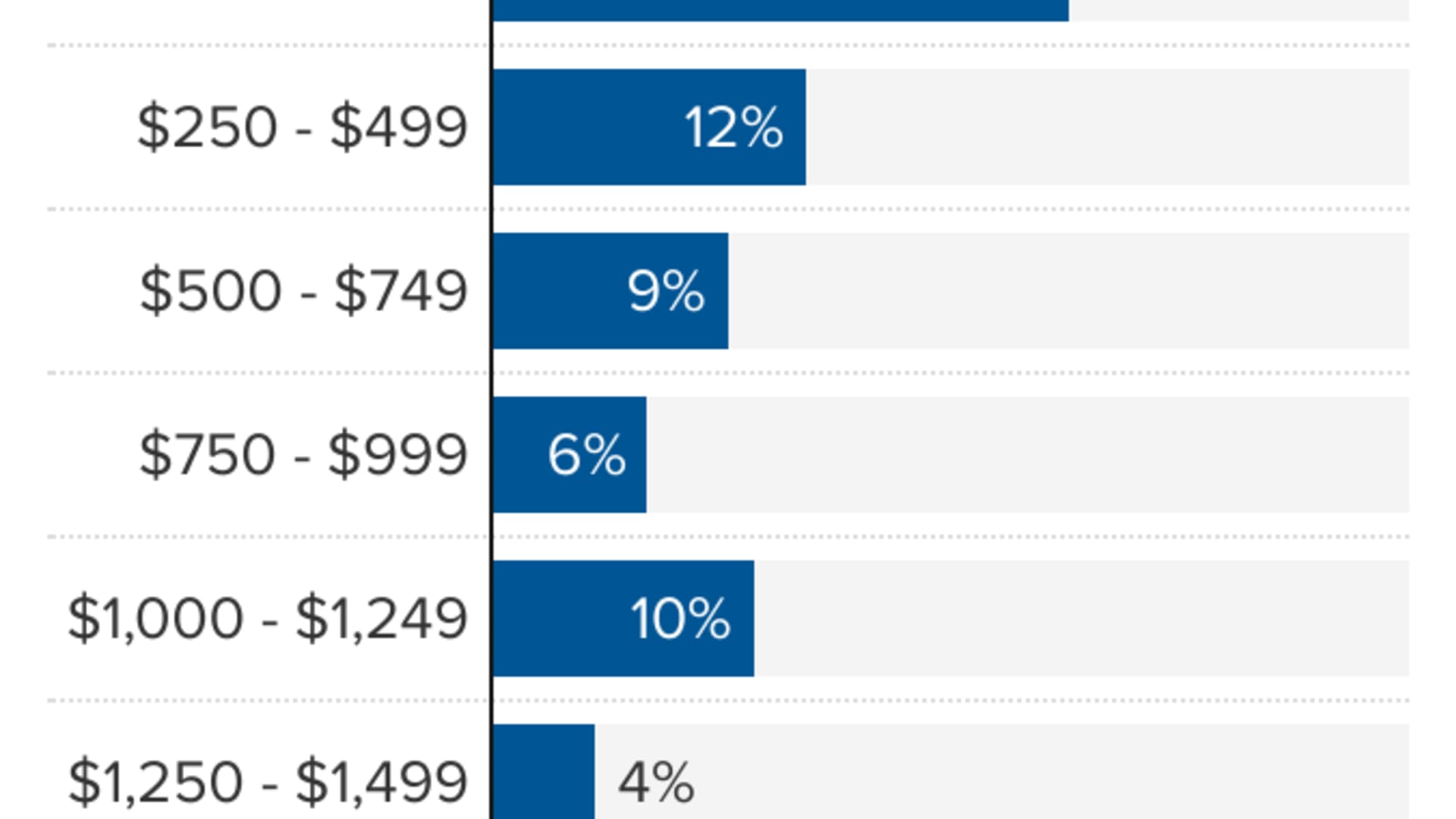

One-third of working adults say they would be very or somewhat uncomfortable with their ability to pay a $400 emergency expense. Moreover, 8% indicated they wouldn't be able to afford it at all.

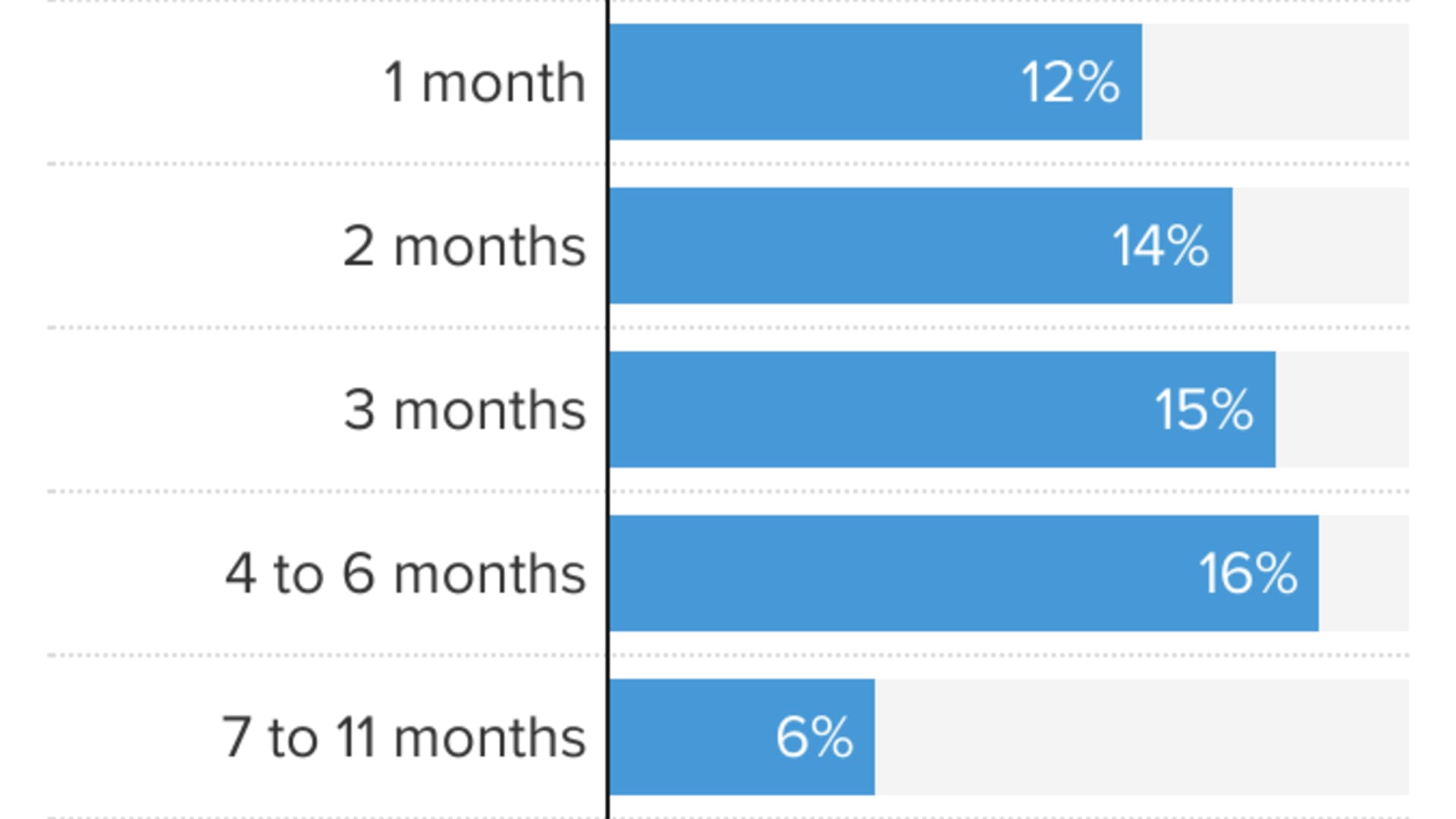

At the same time, 30% of Americans said they could cover a month or less of expenses if their income disappeared.

Those who are more likely to struggle include parents, as well as workers with less than $50,000 in income.

Employed adults have struggled in the past 12 months when it comes to paying down debt, which was cited by 47% of respondents. That is followed by paying utilities and telecom bills, 46%; rent or mortgage, 44%; credit cards, 42%; food, 41%; transportation, 31%; clothing, 19%; recreational goods, 15%; student loans, 14%; child care or tuition, 9%; and other, 4%.

The online survey was conducted on Feb. 10 and included 1,600 employed adults.

Emergency savings plans may help

About 14% of workers have borrowed or withdrawn money from their retirement accounts in the past year, according to the survey.

If employers offered another benefit — emergency savings accounts — that may help employees establish a financial buffer and prevent them from dipping into their long-term investments.

Like retirement plans, the emergency savings accounts would be linked to payroll. Workers could choose to set aside an after-tax portion of their paychecks toward their emergency savings funds. Should an unexpected event arise, they would be able to access the money penalty-free.

The survey found 60% of employed adults would be interested in this option.

Currently, just 21% of workers say their employer offers a workplace emergency savings account.

Interest in these potential benefits is particularly high among young, Black and Hispanic workers, as well as parents, according to the research.

In fact, the Strengthening Financial Security Through Short-Term Savings Accounts Act that was introduced by Sen. Cory Booker, D-N.J., last year would address that issue. However, it is unclear whether the proposal will move forward.

The proposal calls for a certain percentage of earnings or a fixed amount, as determined by the employer, to be transferred automatically to the savings account each pay period. The accounts would not exceed $10,000, which would be adjusted annually for inflation.