Consumer advocates say they’re preparing for sweeping changes at one of Washington’s newest financial watchdogs under President-elect Donald Trump, whose allies have promised broad deregulation of companies that handle Americans’ money.

The Consumer Financial Protection Bureau is weighing which proposed rules on its agenda to finalize before Republicans resume control of the House, the Senate and the White House in less than two months, sources told NBC News.

During Trump’s first term, the CFPB — a brainchild of Sen. Elizabeth Warren, D-Mass., set up under the Federal Reserve after the 2008 financial crisis — unwound banking regulations while also securing some wins for consumers. They included a $1 billion settlement with Wells Fargo after a fraudulent account-opening scandal, as well as crackdowns on data breaches.

But more recently, Republicans have signaled plans to defang the agency, and Trump has named authors of Project 2025 — which calls for eliminating the CFPB — to influential posts. On Wednesday, multibillionaire Trump donor Elon Musk, who is slated for a high-level cost-cutting role, posted on his social platform X: “Delete CFPB.”

Delete CFPB. There are too many duplicative regulatory agencies.

— Elon Musk (@elonmusk) November 27, 2024

“I would expect a deregulatory approach on rules and also efforts to dismantle the agency itself,” said Adam Rust, the director of financial services for the Consumer Federation of America, a network of advocacy groups.

Jesse Van Tol, who leads the National Community Reinvestment Coalition, which focuses on wealth-building in underserved communities, said that “gutting the CFPB is an open invitation to the worst actors in our economy to start screwing over working people again.” He called the agency “the most effective protector of working-class wallets in modern American history.”

U.S. & World

CFPB Director Rohit Chopra, whom consumer advocates expect to be replaced upon Trump’s taking office, has overseen an aggressive period atop the agency. It has clawed back nearly $20 billion in consumer relief and issued a litany of rules and guidance aiming to rein in financial institutions.

The financial services industry bristles at many of these efforts. The last four years have “seen the CFPB deviate from fact-based policy making and, instead, lurch into political campaigning,” Lindsey Johnson, president and CEO of the Consumer Bankers Association, said in a statement.

She said the Biden administration’s crackdown on junk fees, for example, was “based on political polling meant to support a reelection campaign, instead of actual data about consumer harm. This resulted in a range of policies, some of which the current CFPB is rushing to finalize, that stand to raise costs for nearly all Americans and will ultimately de-bank many Americans.”

The White House has argued the reverse — that its efforts target inflationary banking practices and lower customers’ costs. A spokesperson for the Trump transition team didn’t respond to a request for comment.

Some of the CFPB’s rules, including one issued last week expanding oversight of digital payment apps like Apple Pay and Venmo, have already garnered GOP support and aren’t likely to be scrapped, experts say. After the rule was finalized, a financial policy adviser to Vice President-elect JD Vance thanked the agency on X for “putting an end to conservative and conservative-coded industries from being debanked.”

Agency leaders face tough choices between now and Inauguration Day, consumer groups say: They can either race to enshrine more protections — which, if repealed under the Congressional Review Act, would prevent future officials from proposing similar ones — or hold off in the hope that Republicans will let well-received guidance stand.

CFPB officials know they can’t bulletproof their work for the next four years, according to a person familiar with leadership thinking who wasn’t authorized to discuss it publicly. But the current administration’s moves could prove more durable than some in the industry expect, the person said. Agency staffers’ recent efforts have demanded patience, resources and prioritization — especially amid intense legal pushback — and their successors under Trump could well find the same, the person said.

The agency declined to comment on the record but said that it “continues to carry out its work separate and apart from political cycles.”

Like everything else in Washington, much of what happens next comes down to politics. Here’s what experts say could change.

Limits on overdraft and insufficient fund fees

Consumer advocates say the most significant potential shift would affect what consumers pay for bank overdrafts.

In September, the CFPB strengthened the government’s ability to penalize banks that charge customers for insufficient funds, clarifying that such fees require an opt-in under the Electronic Fund Transfer Act. While many large banks have backed away from the practice in recent years, it’s uncertain whether that reprieve will come for customers at smaller banks — some of which have sued in response.

“That is really where the rubber hits the road, because everyone’s had an overdraft,” said Rust. “This is not some complicated, arcane financial-protection issue associated with a rule that you have to be in the know to understand.”

That’s why experts say it’s possible the new administration — which campaigned on a “populist” agenda — could leave the guidance alone.

Capped credit card late fees

Chances are slim, however, that an earlier ruling capping credit card fees will survive, advocates and lawyers say.

Issued in March, the move slashed the limit from $32 to $8 and drew swift legal pushback. The case is tied up in the federal court system, with card issuers arguing the changes would force them to pass higher costs on to customers, including those who pay bills on time.

“You can very much see a future CFPB deciding to let the free market decide these fees and go back [to] that $30 limit, not keep it at $8, and not defend vigorously that suit against the rule by industry,” said Armen Meyer, a financial policy consultant who has served as both a fintech industry executive and a bank regulator.

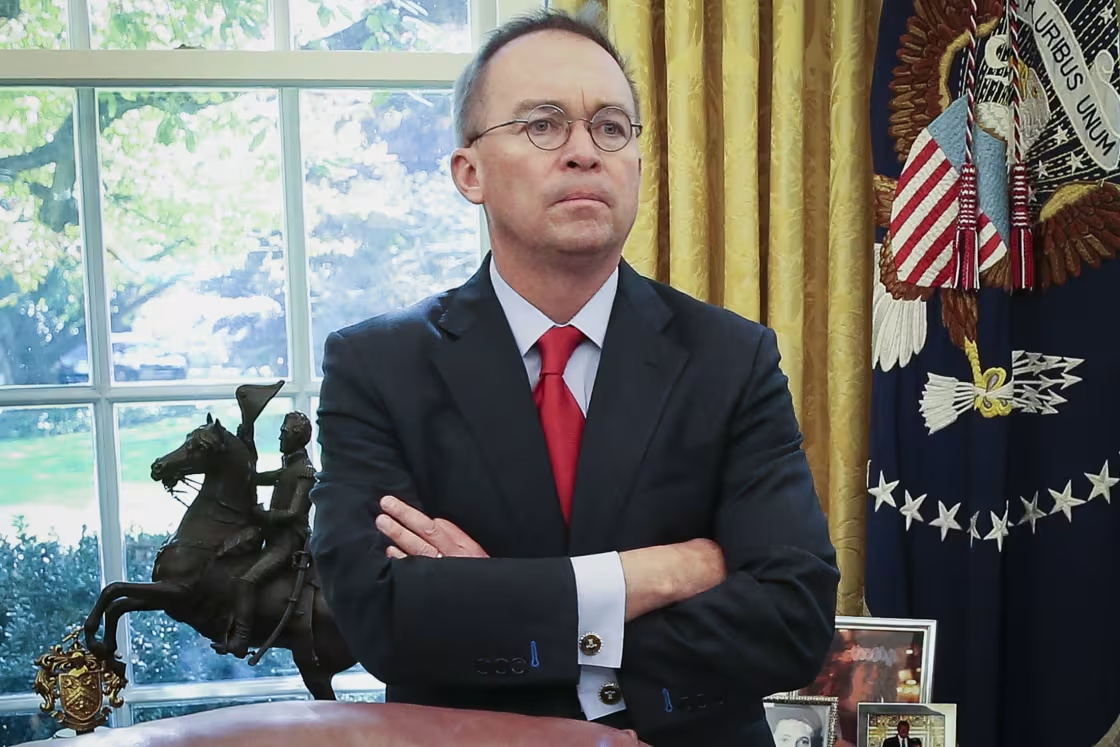

The return to a more hands-off approach could renew complaints that consumer advocates lodged during Trump’s first term. At the time, then-CFPB Director Mick Mulvaney faced criticism for moves they saw as weakening safeguards for borrowers.

Buy now, pay later protections

As BNPL services skyrocketed in popularity during the pandemic, the agency quickly built guardrails around them. But in the absence of new legislation, the CFPB determined that the installment loan services had to follow the same regulations as credit card issuers.

That will likely result in those protections disintegrating, Meyer said.

“I think most people would agree with the general matter,” he said, citing concerns of overspending and potential exploitation. “The industry would disagree in terms of how that was done, which they feel doesn’t fit and makes it hard for them to do their business.”

The rule allowed users of services like Klarna and Affirm to dispute charges and demand refunds after returning purchases. Chopra clarified in September that the measure would rely on “good faith” for the time being and that violations wouldn’t be penalized during the transition.

Removal of medical debt from credit reports

This summer, the agency proposed banning medical debt from appearing on consumers’ credit reports. And in October it warned companies against seeking payment on inflated or unverified bills — prompting another wave of litigation from debt collectors who claimed complying with those requirements would be burdensome.

The agency estimated that its medical debt action would remove as much as $49 billion from 15 million credit reports. Legal experts who follow the CFPB say the agency will likely finalize this proposal before Trump takes office; Reuters reported Wednesday that officials are working to do just that, citing sources familiar with the matter. That would leave the measure vulnerable to congressional review, but it remains uncertain how the next director might approach it.

The CFPB declined to comment on the medical debt rulemaking but said it “continues to carry out its work separate and apart from political cycles.”

The source familiar with agency decision-making said some state regulators are likely to take the lead on the issue in coming months, with Colorado and New York recently enacting curbs on medical debt reporting.

California Attorney General Rob Bonta proposed similar legislation this year and later sent a letter to the CFPB cheering it for setting a “floor for consumer protections” and letting states enact stronger ones.

As with other policy issues — from immigration and reproductive rights to emissions mandates — the rules around Americans’ finances might increasingly depend on where they live.

This story first appeared on NBCNews.com. More from NBC News: