- The National Basketball Association sees a bright future with virtual signage on its courts, which industry insiders estimate is valued at roughly $15,000 per quarter for local ads.

- On Tuesday, the NHL also added jersey patches to its sponsorship offerings.

- The NHL secured $676 million in sponsorship money for the 2020-21 season, according to IEG.

From the NBA to the NHL, top U.S. sports leagues are carving out more space on for advertisers to get visibility and help networks to recover from Covid-19 losses.

The National Basketball Association wants further to expand its sponsorships with virtual advertisements on the court. After placing ads near on-deck circles and behind the pitcher's mound, Major League Baseball joined the patch party with logos on officials' uniforms. And the National Hockey League inserted helmet ads to make up for pandemic losses suffered by corporate partners. The NHL jumped on the jersey patch trend adopted by other sports.

The NHL plans to add the jersey patch starting in its 2022-23 season, according to the Associated Press. By then, the sports sponsorship market could get cluttered, especially at the team level.

"It feels like we're selling the bits and pieces now," said Peter Laatz, global managing director at sponsorship valuation firm IEG. "Everyone is trying to fill in holes that were created last year."

NBA leveraging the basketball court

Jersey patches aren't anything new. The NBA started to leverage uniforms with its program in 2017, and Laatz said the concept is "something that's been done for years with European soccer clubs."

U.S. & World

MLB used virtual ads that appear behind home plate since the 2001 World Series. The premium real estate is only for national partners, including Fox Sports, which has the rights to the championship games. MLB works with ad tech firm Brand Brigade to create the signage and attracts eight figures for the slots, which has value because of its placement in the main shot of a game's broadcast.

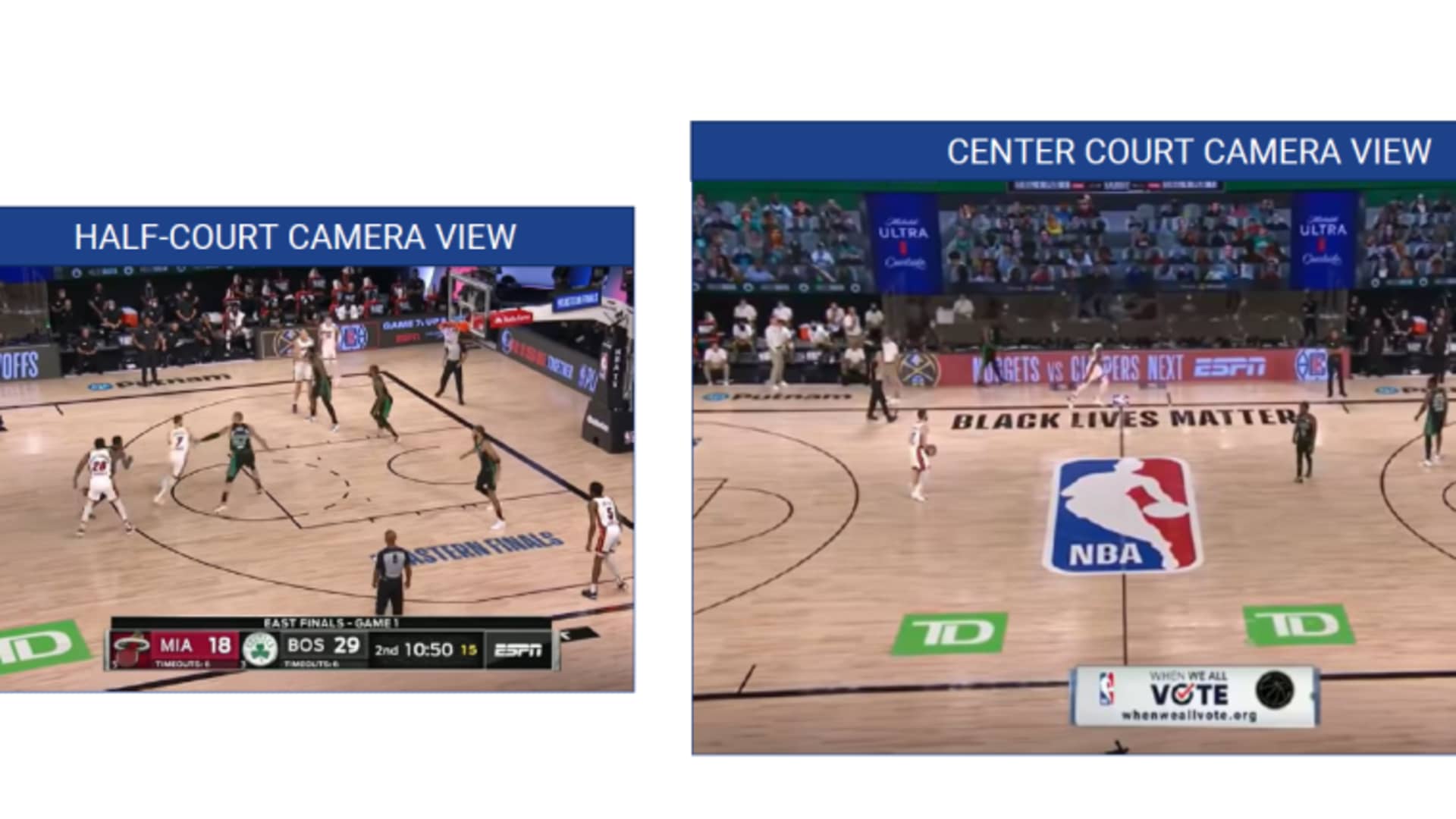

Last year, during its Orlando bubble, the NBA rolled out its version of virtual ads, or logos that are interchangeable on the court for TV audiences. League officials provided guidelines on which colors to avoid, the size of the logos and ad placement. The NBA used the ads again for its 2020-21 season and permitted regional sports networks to access the asset.

Networks are allowed two sponsors per game. To receive the national TV real estate, companies need to obtain significant media deals with the NBA and its partners. On the regional front, industry insiders suggest the ads solicit roughly $15,000 per quarter.

Laatz called the NBA virtual ads "disruptive, in a good way," as they have the potential of catching the viewers' attention. Jeff Marks, the CEO of Innovative Partnership Group, a sports business firm that helps negotiate agreements for teams, labeled the NBA ads as a "high-value asset" due to the on-court location. Also, brands can strike deals that include virtual ads and grant rotation on NBA sideline boards below the scorer's table.

"It's probably the most valuable naming rights inventory that we see for NBA teams," said Marks of the in-game TV signage. "They're significant assets with the amount of impressions you get."

The NBA has made over $150 million since launching its jersey patch program, but its patch money appears stagnant. Hence, the league enhanced visibility (increased logo sizes) to raise value and created practice jersey options.

The NBA's record-high $1.46 billion in sponsorship revenue should only reach new heights if the virtual ads establish a good media value.

NHL will have challenges with its jersey plans

The NHL is also no stranger to virtual ads, and it plans to unleash jersey patches soon. The league is taking advantage of the extra TV exposure now that ESPN and WarnerMedia are media partners.

Teams like the Detroit Red Wings and Dallas Stars already took full advantage of the helmet sponsorships. A study from research firm Morning Consult suggested consumers approve of the ads, which helped the NHL secure $676 million in sponsorship money for the 2020-21 season, according to IEG.

"But a lot of the helmet sponsorship wasn't new money," Laatz said. "It was make-goods inventory. So that's maybe what you see here (with the NHL patch) – trying to find more real estate to put logos."

The thing is, the NHL's newest asset isn't as shiny as the other leagues.

The speed of play in hockey doesn't offer excellent visibility like the NBA, which allows brands to capitalize from free-throw line close-ups. And though it's accepted in the sport, the violence associated with the NHL is risky for corporate partners.

"Buyers of the patch would be smart to raise the pace of play conversation," Laatz said.

In addition, the NHL already has an abundance of ads that appear in its telecast. The most effective is the dasher board spots, as these ads provide consumers a "good contrast" of ads and offer "good returns for sponsors," noted Laatz.

When discussing estimations of what the NHL could bring in from the new patch, Laatz predicted the NHL wouldn't solicit as much at the NBA. "People don't follow individual NHL players the way they follow NBA stars," he said. "The star power piece is different."

Jersey clutter is coming

The NHL's launch of jersey patches will lead to a crowded sponsorship space by 2023.

There are arena naming rights, sports drink rights and now an overload of jersey patches. Also, keep in mind, Major League Soccer its has patch offerings, and international soccer clubs like PSG are slowly creeping into the U.S. landscape.

"That's a fair assessment to make," Laatz said of a cluttered sponsorship market on the horizon. "It doesn't necessarily devalue anything. It just makes the conversation about the stuff that already existed – is it worth more or less."

But Laatz cautioned brands shouldn't associate with new sports sponsorships unless it offers accurate returns once the games on TV conclude.

"Consumer sentiment is different than media exposure which is very binary," he said. "The eyeballs were there, or they weren't. Consumer sentiment is about [discussing the product after the ad]."

But with the NHL's move, multi-team ownership groups could benefit.

Monumental Sports and Entertainment is taking the lead here. The group owns the NHL franchise Washington Capitals, NBA's Wizards and WNBA's Mystics franchises. MSE combined its jersey patches, and the group is seeking $12 million for its patch, stretching the asset across four teams, including esports and the NBA G League.

Laatz praised the creative combination, calling it a "miniature naming rights" opportunity. The Capitals could be a part of the package in the future, which only increases the MSE's patch value.

"It's great," Laatz said of MSE's move. "Brands can do one transaction, one contract, and get a jersey patch asset across multiple clubs. At times, multiple entry points across multiple contractual terms can get complex for buyers, so this is a benefit. If the rules are relativity the same, the marketing, merchandising – if I'm a buyer, I'm looking at this combination."