The Latest

-

State police sgt. expected to return to witness stand Monday in Karen Read trial

Karen Read’s second murder trial will enter its fourth week in court on Monday, and is expected to pick back up with more testimony from a state police sergeant who worked on the investigation into John O’Keefe’s death in 2022.

-

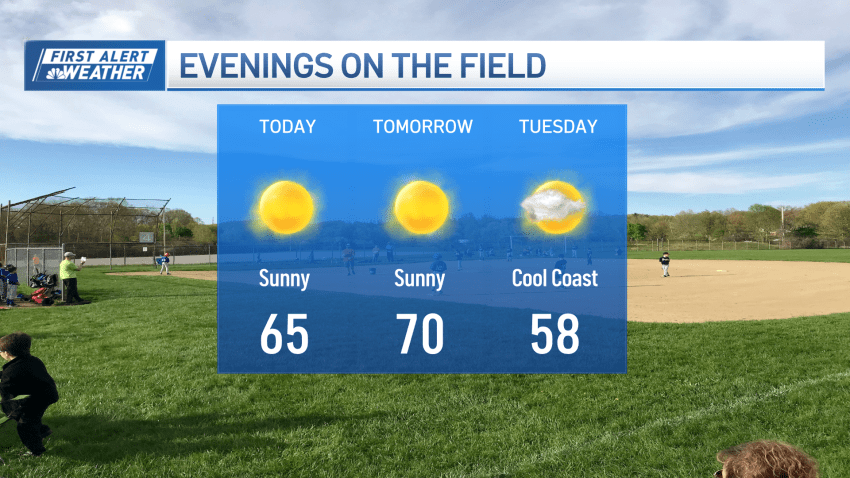

Work week kicks off with more beautiful spring weather

Monday is off to a beautiful start with sunshine, light winds and comfortable conditions across southern New England.

-

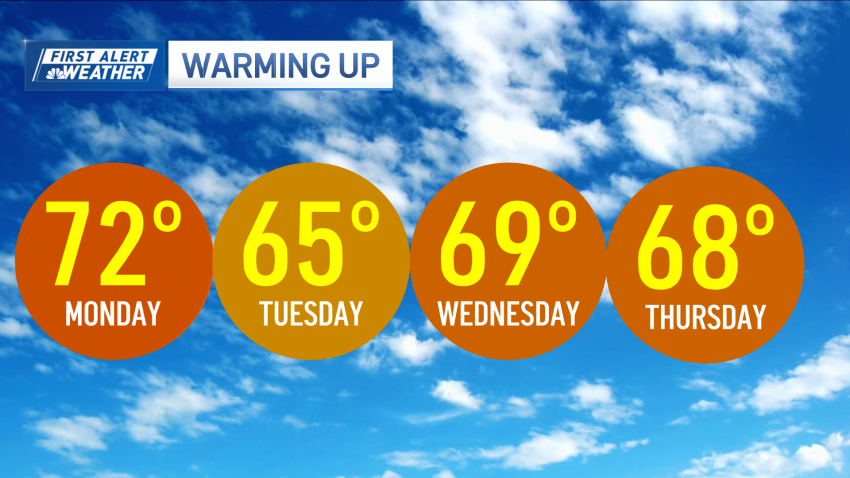

More sunshine and warmth to kick off the workweek

We’re looking at more sunshine and warmth in Boston this week, though rain chances return late Tuesday.

-

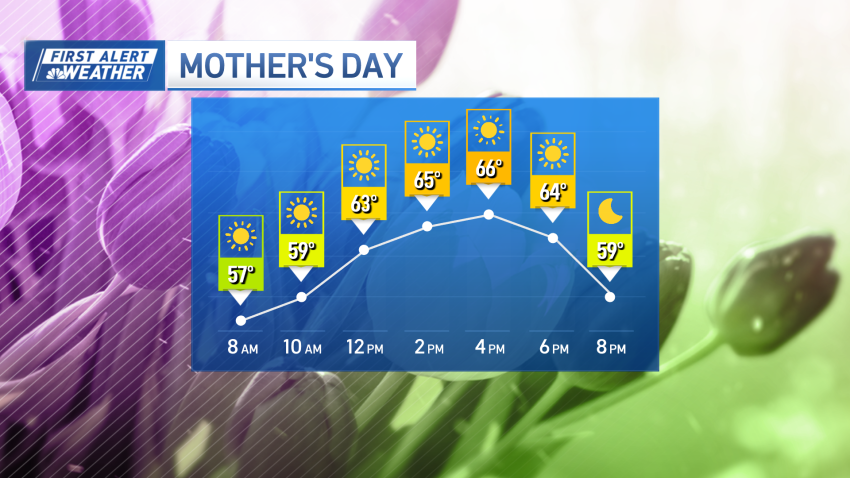

Rain leaves, sun returns just in time for Mother's Day

After a rainy stretch, Mother’s Day is bringing back the sunshine.

-

Celtics rout Knicks 115-93 to cut New York's series lead to 2-1

Jayson Tatum had 22 points, nine rebounds and seven assists, Payton Pritchard scored 23 points and Boston easily got its first win in the Eastern Conference semifinals by routing New York 115-93 on Saturday.

-

Mazzulla sums up C's mentality with epic quote after Game 3

Celtics coach Joe Mazzulla perfectly described his team’s mentality with an on-brand quote after the team’s blowout Game 3 win over the Knicks.

-

Pritchard, C's role players outclass Knicks' supporting cast in Game 3

Payton Pritchard and the Celtics’ supporting cast were the difference in Boston’s lopsided Game 3 win over the Knicks.

-

Death of man in Lynnfield being investigated as apparent homicide

A man was found dead in Lynnfield, Massachusetts, Friday night and police are investigating the case as an apparent homicide, authorities said.

-

Bill Belichick cheers on girlfriend Jordon Hudson on at Miss Maine USA

Isabelle St. Cyr is making history as the first transgender woman to compete in the pageant, while Bill Belichick’s girlfriend Jordan Hudson was runner-up last year.