The Latest

-

Testimony to resume today after some fireworks in Karen Read's retrial Tuesday

Prosecutors in Karen Read’s second murder case on Tuesday introduced a series of angry voicemails that she left for her Boston police officer boyfriend in the hours before he was found in the snow.

-

Sunshine returns today but we're not done with the rain for the week just yet

We’re tracking a light at the end of the tunnel – with actual sunshine on the way!

-

Massachusetts business outlook hits pandemic-era low

Mass. business outlook hits pandemic-era low

-

Tom Thibodeau has roots in Mass., and with Celtics, as he leads Knicks to playoff battle

Long before being known as a defensive-minded NBA coach, Tom Thibodeau’s coach at Salem State says he was a “terrible defensive player” — although the power forward’s co-captain praised his shooting.

-

Why Kyle Dugger is primed for a bounce-back season with Patriots

Phil Perry and Andrew Callahan explain why they believe Patriots safety Kyle Dugger will have a bounce-back season in 2025.

-

DHS says travelers with no REAL ID can fly for now, but with likely extra steps

Secretary of Homeland Security Kristi Noem said travelers who have not obtained a REAL ID by the deadline can fly after additional identity checks

-

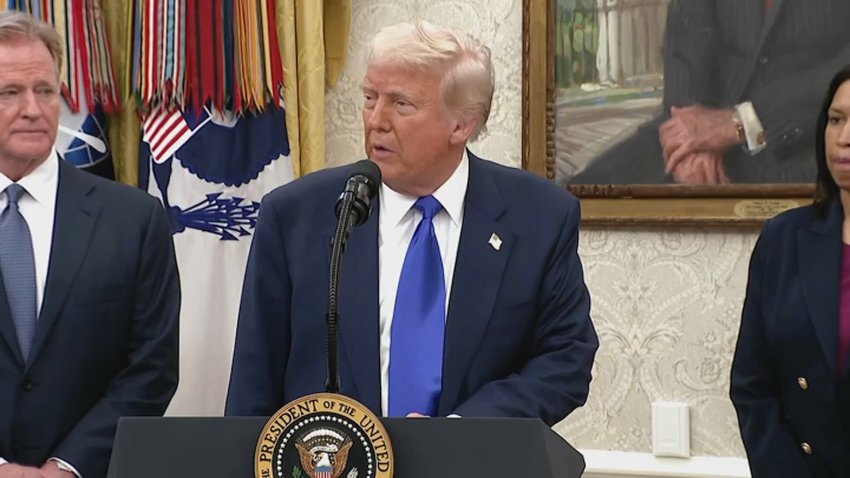

Trump offers $1,000 for undocumented immigrants to self-deport, but how will it work?

As President Donald Trump pushes to ramp up deportations, he announced an incentive for people to self-deport using the CBP Home app

-

Bruins GM Don Sweeney gives head coaching search update

Bruins general manager Don Sweeney shared a new coaching search update after the results of the 2025 NHL Draft Lottery.

-

MLB Power Rankings roundup: Red Sox slipping amid inconsistent start

Here’s how the Red Sox are viewed nationally amid an up-and-down start to their 2025 campaign.

-

Ranking Red Sox' best Triston Casas replacement options at first base

Who should take over for Triston Casas as the Red Sox’ everyday first baseman? We ranked Boston’s options from best to worst.

-

Friends to enemies? Thibodeau's basketball journey was shaped by time in Boston

He may have orchestrated a Game 1 win for the Knicks against the Celtics, but coach Tom Thibodeau’s basketball journey is deeply embedded in Massachusetts.

-

Celtics' issue in Game 1 loss to Knicks was quality, not quantity

The Celtics’ poor 3-point shooting wasn’t the only reason they lost Game 1 to the Knicks. Chris Forsberg breaks down Boston’s vexing defeat.

-

Patriots reveal jersey numbers for 2025 rookie class

The Patriots’ 2025 rookie class has new jersey numbers for the upcoming season.